As fintech startups continue to disrupt the financial industry, the adoption of cloud computing has become increasingly prevalent. As a leading cloud service provider, Amazon Web Services (AWS) offers a robust platform that empowers fintech startups to scale their operations rapidly. However, given the sensitive nature of financial data, ensuring cloud security is paramount.

This article will explore key considerations and best practices for enhancing cloud security for fintech startups on AWS.

Security but How?

Data Encryption

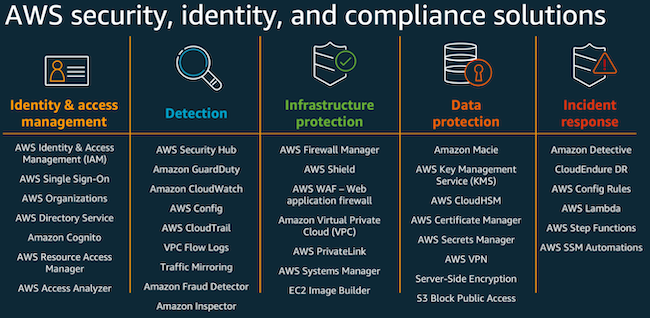

Data encryption is the foundation of cloud security. Fintech startups should employ encryption mechanisms to protect sensitive information in transit and at rest. AWS provides various encryption services, such as AWS Key Management Service (KMS) and AWS Certificate Manager, allowing startups to safeguard data, API keys, and digital certificates.Identity and Access Management (IAM)

IAM plays a vital role in controlling access to AWS resources. Fintech startups should follow the principle of least privilege, granting permissions only to the necessary individuals or services. AWS Identity and Access Management (IAM) enables fine-grained access control, allowing startups to create user accounts, manage credentials, and implement multi-factor authentication (MFA) for an additional layer of security.

Secure Network Configuration

Configuring a secure network architecture is crucial for protecting fintech startups on AWS. Startups should leverage AWS Virtual Private Cloud (VPC) to isolate their resources from the public internet, ensuring that only authorised traffic is allowed. Implementing network access control lists (ACLs) and security groups helps restrict inbound and outbound traffic, reducing the attack surface.

Continuous Monitoring and Logging

Establishing comprehensive monitoring and logging practices is essential to promptly detect and respond to security incidents. AWS provides services like AWS CloudTrail, AWS Config, and Amazon CloudWatch, which enable startups to monitor user activities, track resource changes, and receive real-time alerts for suspicious behaviour. By leveraging these services, fintech startups can maintain visibility into their infrastructure and proactively address potential threats.

Disaster Recovery and Business Continuity

Fintech startups must have robust disaster recovery (DR) and business continuity (BC) plans to ensure uninterrupted operations. AWS offers services like Amazon S3 for data backups, Amazon Glacier for long-term archival storage, and AWS Disaster Recovery for failover solutions. Regularly testing these plans and conducting drills can help fintech startups minimise downtime in the event of an incident.

Security Audits and Compliance

Compliance with industry regulations is critical for fintech startups with sensitive financial data. Startups should conduct regular security audits and assessments to ensure adherence to relevant standards such as PCI-DSS, GDPR, or HIPAA. AWS provides a range of compliance frameworks and services to help startups meet their regulatory obligations, including AWS Artifact and AWS Security Hub.

Employee Education and Awareness

Human error is a common cause of security breaches. Fintech startups should invest in educating their employees about security best practices, including password hygiene, phishing awareness, and safe browsing habits. Conducting regular training sessions and promoting a security-conscious culture will significantly reduce the risk of internal vulnerabilities.

Cloud security is of paramount importance for fintech startups operating on AWS. By implementing robust encryption measures, adopting proper identity and access management, configuring secure network architecture, and ensuring continuous monitoring, startups can enhance their security posture. Disaster recovery plans, security audits, and employee education contribute to a comprehensive cloud security strategy. With these best practices, fintech startups can confidently leverage AWS, knowing their sensitive financial data is safeguarded in the cloud.

Are you a fintech startup looking to maximise the potential of your AWS infrastructure? Don't settle for the ordinary when you can achieve extraordinary results. Unleash the power of our specialised solutions tailored to fintech startups like yours.

Benefits

Experience the following benefits:

- Optimise Performance: Enhance the speed, reliability, and scalability of your AWS environment, ensuring seamless operations even during peak periods of activity.

- Fortify Security: Protect your sensitive financial data with our advanced security measures, fortified by cutting-edge encryption, robust access controls, and continuous monitoring.

- Streamline Operations: Streamline your workflows and automate critical processes with our innovative tools and integrations, enabling you to focus on driving growth and innovation.

- Accelerate Time-to-Market: Gain a competitive edge by leveraging our expert guidance and proven methodologies to accelerate your development cycles and launch new features faster than ever.

- Cost Optimisation: Maximise your cost efficiency with our tailored solutions, ensuring you only pay for the necessary resources without compromising performance or security.

Conclusion

Don't let your fintech startup settle for anything less than exceptional. Leap unparalleled success by partnering with us today!

Contact us now to schedule a consultation and discover how our specialised expertise and cutting-edge solutions can propel your fintech startup to the next level on AWS.

Together, let's transform your vision into reality and achieve remarkable success in the dynamic fintech landscape. The future awaits, and we're here to help you confidently seize it!